Truist Credit Cards are great no matter what your credit situation is. Multiple people were able to get approved for multiple credit cards at one time. Truist Credit Cards used to be able to prequalify you without a hard inquiry but they no longer do that.

Annual Fee

The annual fee for this credit card is $0.

Good Credit & Excellent Credit

Good Credit & Excellent Credit

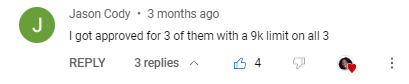

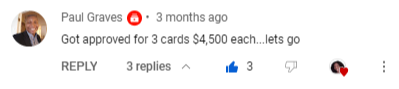

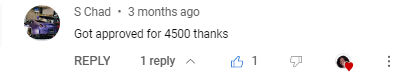

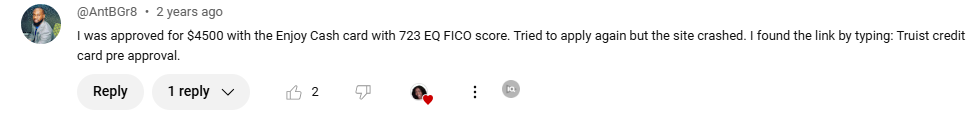

Multiple Cards

You are able to get approved for multiple credit cards.

Credit Reporting

Truist reports to all 3 credit bureaus and will check Transunion, Equifax, or both to approve you.

SIMILAR CREDIT CARDS

Truist Financial Corporation is a leading financial services company that provides banking, insurance, and investment solutions to customers across the United States. The company was formed in 2019 as a result of the merger between BB&T Corporation and SunTrust Banks, Inc. One of the many financial products offered by Truist is their line of credit cards, which are designed to meet the unique needs of different customers. In this blog, we will take a closer look at the Truist credit cards and what they have to offer.

Truist credit cards come in three different types: Rewards, Balance Transfer, and Low-Interest. Each type of card is tailored to meet the specific needs of different customers. For example, if you are someone who frequently uses your credit card for purchases, the Rewards card might be the best option for you. This card allows you to earn points for every dollar you spend, which can be redeemed for travel, merchandise, and cashback. On the other hand, if you have existing credit card debt that you want to transfer to a lower interest rate, the Balance Transfer card might be the best option for you. This card allows you to transfer your high-interest credit card balances to a Truist credit card with a lower interest rate, which can save you a significant amount of money on interest charges.

Truist credit cards also offer a range of benefits and features that make them a popular choice among customers. For example, all Truist credit cards come with zero fraud liability protection, which means that you will not be held responsible for unauthorized charges made on your card. In addition, all Truist credit cards come with contactless payment technology, which allows you to make payments quickly and securely using your smartphone or other mobile device.

Another benefit of Truist credit cards is that they offer a variety of tools and resources to help you manage your credit card account. For example, the Truist mobile app allows you to track your spending, view your account balances and transactions, and make payments from your smartphone or other mobile device. In addition, Truist credit cards come with online account management tools that allow you to view your statements, pay your bills, and manage your rewards points.

Truist credit cards also come with a range of security features to protect your account from fraud and unauthorized use. For example, Truist uses advanced fraud detection technology to monitor your account for suspicious activity and alert you if there is any unusual activity on your account. In addition, Truist credit cards come with chip technology, which provides an extra layer of security when you use your card in person.

If you are someone who is looking for a credit card that offers a range of benefits and features, Truist credit cards are definitely worth considering. Whether you are looking for a card that offers rewards, balance transfers, or low-interest rates, Truist has a card that can meet your needs. In addition, Truist credit cards come with a range of security features and tools that can help you manage your account and protect your finances.

In conclusion, Truist credit cards are a great choice for anyone who is looking for a credit card that offers a range of benefits and features. With their Rewards, Balance Transfer, and Low-Interest cards, Truist has a card that can meet the needs of different customers. In addition, Truist credit cards come with a range of security features and tools that can help you manage your account and protect your finances. So if you are in the market for a new credit card, be sure to check out the Truist credit card offerings and see if they are right for you.

Check out other credit cards

Latest Articles

*Some of the links and other products are from companies for which Rickita will earn an affiliate commission or referral bonus. Rickita is part of an affiliate network and receives compensation for sending traffic to partner sites. The content in videos is accurate as of the posting date. Some of the offers mentioned may no longer be available.

Disclaimer: Rickita strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider, or specific product’s site. All financial products, shopping products, and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. Pre-qualified offers are not binding. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.