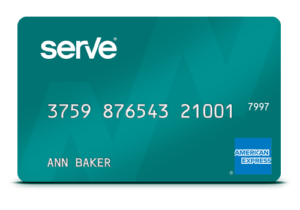

The American Express Serve Card is a reloadable prepaid debit card that functions similarly to a basic debit card tied to a checking account at a traditional bank. A prepaid debit card is an account that allows you to spend only the amount of money that you have loaded into the account in advance.

SIMILAR CREDIT CARDS

The American Express Serve® Card is a prepaid debit card that offers a convenient way to manage your money. Whether you’re looking to control your spending, make purchases online, or pay bills, the Serve Card offers a range of features that can help you achieve your financial goals.

One of the key benefits of the American Express Serve® Card is that it can be used anywhere American Express is accepted. This includes millions of merchants worldwide, making it easy to shop online or in-store. In addition, the Serve Card can be used to withdraw cash from ATMs, making it a convenient way to access your funds.

Another benefit of the Serve Card is that it offers a number of ways to add money to your account. You can add funds directly from your bank account, through a direct deposit from your employer, or by depositing cash at a participating retailer. This flexibility makes it easy to manage your finances and keep your account balance topped up.

One feature of the Serve Card that sets it apart from other prepaid debit cards is the free online bill pay service. With this service, you can pay bills online and avoid the hassle of writing checks or paying for postage. This can save you time and money, and help you stay on top of your financial obligations.

The Serve Card also offers a range of tools and features to help you manage your spending. You can set up alerts to notify you when your balance is low or when a transaction has been made. This can help you avoid overdraft fees or unauthorized charges. In addition, you can set up sub-accounts for family members or friends, making it easy to manage their spending and track their transactions.

Another benefit of the Serve Card is that it offers fraud protection and security features. Your card is protected by a PIN, and you can lock or unlock your card at any time through the online account management portal. In addition, American Express offers fraud protection and will refund any unauthorized transactions that occur on your card.

One potential downside of the Serve Card is that it does charge a monthly fee of $6.95. However, this fee can be waived if you have a direct deposit of $500 or more each month. In addition, there are no activation fees or transaction fees for purchases made with the card.

Overall, the American Express Serve® Card offers a range of features and benefits that can help you manage your finances and stay on top of your spending. Whether you’re looking for a convenient way to pay bills online or want to keep track of your spending with alerts and sub-accounts, the Serve Card can be a great option. Plus, with the added security and fraud protection features, you can use your card with confidence knowing that your funds are safe and secure.

If you’re interested in applying for an American Express Serve® Card, the process is simple and straightforward. You can apply online and receive your card in the mail within a few days. Once you have your card, you can activate it online or through the Serve mobile app, and start using it to manage your finances.

In conclusion, the American Express Serve® Card offers a range of benefits and features that can help you manage your money and stay on top of your financial obligations. With its flexible funding options, free online bill pay service, and range of security and fraud protection features, the Serve Card can be a great option for anyone looking for a convenient and secure way to manage their finances. If you’re interested in learning more about the Serve Card or applying for one, be sure to visit the American Express website for more information.

Check out other credit cards

Latest Articles

*Some of the links and other products are from companies for which Rickita will earn an affiliate commission or referral bonus. Rickita is part of an affiliate network and receives compensation for sending traffic to partner sites. The content in videos is accurate as of the posting date. Some of the offers mentioned may no longer be available.

Disclaimer: Rickita strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider, or specific product’s site. All financial products, shopping products, and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. Pre-qualified offers are not binding. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.