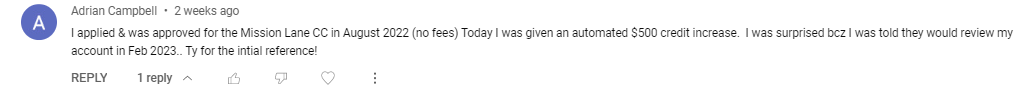

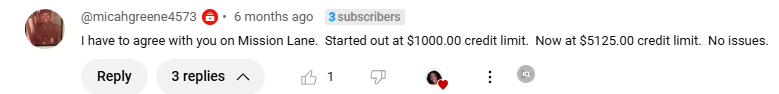

The Mission Lane Visa® Credit Card is designed for individuals looking to build or rebuild their credit with simple and transparent terms. It features no hidden fees, offering a straightforward approach to credit building without surprises. The card reports to all three major credit bureaus, helping you establish a positive credit history through responsible use. With potential credit line increases after as little as six months of on-time payments, it provides an opportunity to grow your credit over time. If you’re seeking a reliable and easy-to-manage credit card to boost your financial health, the Mission Lane Visa Credit Card is a solid option.

Annual Fee

The annual fee for this credit card is

$0 - $75.

Credit Limit

Credit limit starting at $300.

Prequalify

Prequalify for this credit card with NO hard inquiry! TRANSUNION hard pull!

Build Credit Faster

Build your credit faster with credit reporting to all 3 Credit Bureaus.

Exclusive Credit Membership

SIMILAR CREDIT CARDS

- Purchase or have already purchased our Mega Dispute Letter Package. Use the special link provided below to get 65% off your Mega Dispute Letter Package if you haven’t already purchased it:

Dispute Letter Package

2. Sign up for Aura.com/rickita 14 day free trial to get your free reports (This will allow us to view your reports and lock Experian report)

3. Get all 3 of your credit reports from IDIQ $1 Trial:IDIQ Trial

4. Complete an application: Credit Application

5. Once you’ve made your purchase, reach out to our customer support team at 833-742-5482 to confirm your eligibility for the free letter service.