The Petal® 1 “No Annual Fee” Visa® Credit Card is a great choice for individuals looking to build credit while avoiding traditional fees. This innovative card is designed for those with little to no credit history, offering credit limits ranging from $300 to $5,000 based on factors like income and spending habits. With no annual fee, late fees, or foreign transaction fees, it’s a budget-friendly option. Cardholders can earn cashback rewards of 2% to 10% at select merchants, making it one of the few entry-level cards that offer perks. If you’re looking for a straightforward, no-fee way to build credit while enjoying cashback rewards, the Petal 1 Credit Card is an excellent choice.

No Annual Fee

The annual fee for this credit card is $0.

Credit Limit

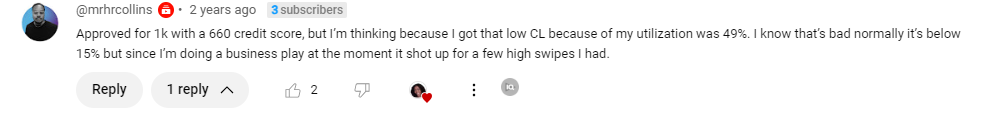

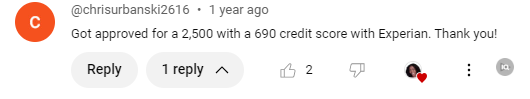

Credit limit approval will be between $300 - $5,000. Approval amount will differ depending on your credit score and banking history.

Pre-qualify

Pre-qualify with NO Hard inquiry. They will us a platform called Plaid to look at your banking history and do a soft pull to your credit reports.

No Foreign Transaction Fees

No transaction fees when using this credit card outside of the country.

Exclusive Credit Membership

SIMILAR CREDIT CARDS

- Purchase or have already purchased our Mega Dispute Letter Package. Use the special link provided below to get 65% off your Mega Dispute Letter Package if you haven’t already purchased it:

Dispute Letter Package

2. Sign up for Aura.com/rickita 14 day free trial to get your free reports (This will allow us to view your reports and lock Experian report)

3. Get all 3 of your credit reports from IDIQ $1 Trial:IDIQ Trial

4. Complete an application: Credit Application

5. Once you’ve made your purchase, reach out to our customer support team at 833-742-5482 to confirm your eligibility for the free letter service.