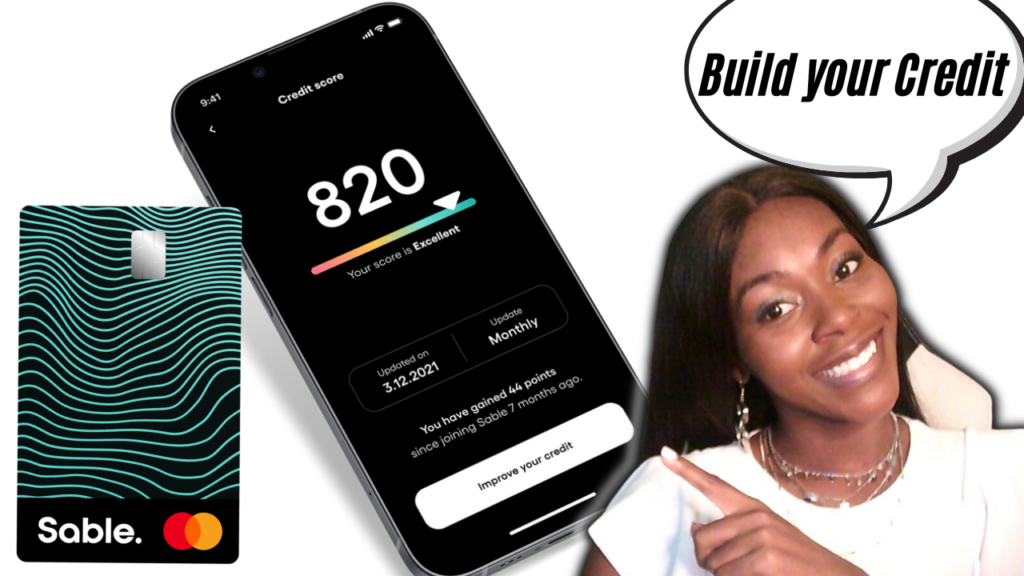

The Sable Secured Card makes the most sense for those lacking a credit history or needing to rebuild damaged credit. Sable gives cardholders the ability to build credit while also earning cash back.

Annual Fee

The annual fee for this credit card is $0.

Deposit Required

This is a secured card

Prequalify

Prequalify for this credit card with NO hard inquiry!

Credit Reporting

Sable One reports to all 3 credit bureaus.

SIMILAR CREDIT CARDS

Credit cards are a popular way for people to pay for goods and services. They offer convenience, flexibility, and rewards, among other benefits. However, not everyone has access to credit cards, especially those with a poor credit history or no credit history at all. This is where secured credit cards come in. A secured credit card is a type of credit card that requires the user to make a security deposit to access credit. In this blog post, we will be discussing the Sable One Secured Credit Card.

The Sable One Secured Credit Card is a new entrant in the world of secured credit cards. It was launched in 2021 by Sable, a fintech company that is focused on financial inclusion. The card is designed to help people build their credit history, especially those who have had difficulty getting approved for credit in the past.

How the Sable One Secured Credit Card Works

The Sable One Secured Credit Card works like any other secured credit card. The user is required to make a security deposit to access credit. The security deposit serves as collateral for the credit limit on the card. The user can then use the card to make purchases, just like a regular credit card. The user is required to make monthly payments on the balance, just like a regular credit card. The payment history is reported to the credit bureaus, which helps the user build their credit history.

The security deposit required for the Sable One Secured Credit Card is $100. This is a relatively low amount compared to other secured credit cards, which can require security deposits of $200 or more. The credit limit on the card is equal to the security deposit. So, if you make a $100 security deposit, you will have a $100 credit limit on the card.

The Sable One Secured Credit Card has an annual fee of $35. This is also lower than the annual fees of many other secured credit cards, which can range from $50 to $100 or more. The APR on the card is 17.99%, which is on the higher side compared to some other secured credit cards. However, it is still lower than the APR on many unsecured credit cards, which can be as high as 25% or more.

Benefits of the Sable One Secured Credit Card

The Sable One Secured Credit Card has several benefits that make it an attractive option for people looking to build their credit history.

- Low Security Deposit

The Sable One Secured Credit Card has a low security deposit requirement of $100. This makes it accessible to people who may not have a lot of money to put down as collateral. It also means that people can start building their credit history with a relatively small investment.

- Low Annual Fee

The Sable One Secured Credit Card has a low annual fee of $35. This is lower than many other secured credit cards, which can have annual fees of $50 to $100 or more. The low annual fee makes the card more affordable for people who are trying to build their credit history.

- Credit Limit Increases

The Sable One Secured Credit Card offers credit limit increases. After six months of responsible use, the user may be eligible for a credit limit increase. This means that they can access more credit without having to make an additional security deposit.

- Rewards Program

The Sable One Secured Credit Card has a rewards program. The user can earn 1% cashback on eligible purchases. This is a nice perk that can help offset some of the costs associated with using the card.

Check out other credit cards

Latest Articles

*Some of the links and other products are from companies for which Rickita will earn an affiliate commission or referral bonus. Rickita is part of an affiliate network and receives compensation for sending traffic to partner sites. The content in videos is accurate as of the posting date. Some of the offers mentioned may no longer be available.

Disclaimer: Rickita strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider, or specific product’s site. All financial products, shopping products, and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. Pre-qualified offers are not binding. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.