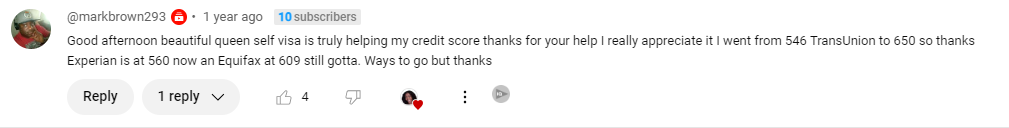

The Self Visa® Credit Card is a game-changer for individuals looking to build or rebuild their credit history while saving money. This secured credit card is specifically designed for those enrolled in a Self Credit Builder Account, allowing you to establish credit without a traditional credit check. One of the best features of the Self Visa Credit Card is its dual purpose—it helps you improve your credit score while giving you access to a secured credit line funded by your savings. With no hard credit inquiry and reporting to all three major credit bureaus, it’s an excellent choice for building positive credit habits. If you’re searching for a low-risk, effective way to build credit, the Self Visa Credit Card is a reliable and straightforward option.

Annual Fee

The annual fee for this credit card is $25. They will take your fee out of your available balance once you apply for the credit card.

Credit Limit

Credit limit approval will be between $100- $1,500. Your credit limit will be based on how much you deposit in your account.

NO Hard Inquiry

NO Hard inquiry!

Build Credit Faster

Build your credit faster with 2 accounts reporting to all 3 Credit Bureaus.

Exclusive Credit Membership

SIMILAR CREDIT CARDS

- Purchase or have already purchased our Mega Dispute Letter Package. Use the special link provided below to get 65% off your Mega Dispute Letter Package if you haven’t already purchased it:

Dispute Letter Package

2. Sign up for Aura.com/rickita 14 day free trial to get your free reports (This will allow us to view your reports and lock Experian report)

3. Get all 3 of your credit reports from IDIQ $1 Trial:IDIQ Trial

4. Complete an application: Credit Application

5. Once you’ve made your purchase, reach out to our customer support team at 833-742-5482 to confirm your eligibility for the free letter service.