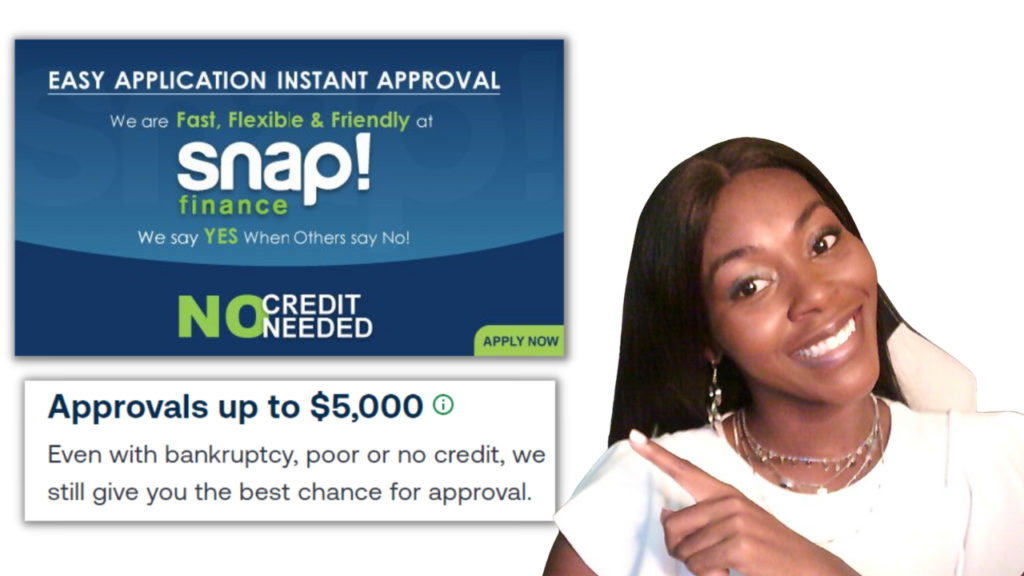

Snap Finance will finance purchases for people new to credit or those with bad credit. Even if you have no credit, Snap is a great way to finance the things you need. It’s not a traditional loan, but a consumer lease that spreads out your purchase over 12 months of easy payments.

Annual Fee

The account gives you a loan and not a credit card.

Same as Cash

Same as cash option available.

Prequalify

Prequalify for this credit card with NO hard inquiry!

Credit Reporting

Snap does not report to any credit bureau.

SIMILAR CREDIT CARDS

In today’s world, having a good credit rating is critical to obtaining credit. However, many people find themselves in a situation where their credit score isn’t necessarily where it needs to be. This is where Snap Finance comes in – a great alternative to traditional loans.

What is Snap Finance?

Snap Finance is a consumer lease program that allows you to finance the things you need, even if you’ve never had credit, or if you have bad credit. It provides an easy and flexible payment plan of 12 months which is perfect for those who need to purchase something but don’t have the means to pay upfront.

One of the primary advantages of Snap Finance is that it’s not a traditional loan. This lease program is focused on leasing options that are easy to understand and offer flexibility to those with poor credit ratings. Therefore, Snap Finance provides a unique alternative to people who are looking for a reliable finance option, without worrying about their credit history.

How does it work?

Snap Finance’s leasing process is straightforward. You start by applying for credit, which is easy and takes only a few minutes. You then receive a decision from Snap about whether your application has been approved. Once your application has been approved, you’re ready to start shopping with no money down.

Snap repays the cost of your purchased item to the dealer, and you’re given a 12-month lease agreement with flexible payments. During this time, you will make monthly payments to Snap until the lease agreement is over. After you have paid off the full amount, the lease comes to an end, and you officially become the owner of the product.

What can you finance with Snap Finance?

Snap Finance covers a wide range of products, including furniture, appliances, jewelry, electronics, tires, and more. Whether you need new tires for your car, a new chair for your office, or the latest smart TV, Snap Finance can help you to purchase it.

Benefits of using Snap Finance

Easy application process: Applying for Snap Finance is straightforward, and you can complete your application in just a few minutes. Snap Finance reviews your information quickly, so you’ll typically receive a reply promptly.

No hidden fees: With Snap Finance, there are no hidden fees or charges. The lease agreement is transparent and upfront, so you’ll know exactly what you’re paying for.

No money down: Snap Finance requires no upfront fees or deposits which makes it a perfect option for those who don’t have the necessary funds to pay upfront.

Flexible payments: Snap Finance’s 12-month lease agreement provides flexible payment options that suit your budget.

Approval for low credit scores: Snap Finance offers finance to people with bad credit and even those without an established credit history. So, if you’re worried about your credit score, Snap Finance may offer a great alternative.

Conclusion

If you’re in need of a new purchase, but your credit score is preventing you from taking out a traditional loan, then Snap Finance may be the perfect solution. With its easy application process, no hidden fees, and flexible payments, Snap Finance offers you the chance to lease the item you need today and pay for it over a 12-month period. Don’t let your credit history hold you back – Snap Finance can help.

Check out other credit cards

Latest Articles

*Some of the links and other products are from companies for which Rickita will earn an affiliate commission or referral bonus. Rickita is part of an affiliate network and receives compensation for sending traffic to partner sites. The content in videos is accurate as of the posting date. Some of the offers mentioned may no longer be available.

Disclaimer: Rickita strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider, or specific product’s site. All financial products, shopping products, and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. Pre-qualified offers are not binding. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.