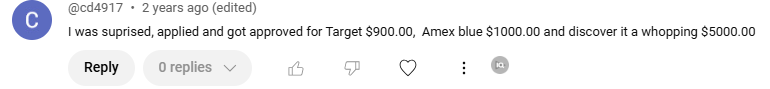

The Target Credit Card (commonly known as the Target RedCard™) is a fantastic choice for frequent Target shoppers looking to save on everyday purchases. Rickita personally has this card and uses it for couponing. Cardholders enjoy an automatic 5% discount on all Target purchases, both in-store and online, including groceries, electronics, and household essentials. Additional perks include free standard shipping on most items from Target.com and an extended return period for an extra 30 days. With no annual fee, this card provides unbeatable value for loyal Target customers. If you’re looking to maximize your savings while shopping at Target, the Target RedCard™ is a must-have addition to your wallet.

Annual Fee

The annual fee for this credit card is $0.

Cashback

5% cashback available.

Prequalify

Prequalify for this credit card with NO hard inquiry!

Target will pull your Equifax Credit Report.

Credit Reporting

Target reports to all 3 credit bureaus and will check Equifax credit card to approve you.

Exclusive Credit Membership

SIMILAR CREDIT CARDS

- Purchase or have already purchased our Mega Dispute Letter Package. Use the special link provided below to get 65% off your Mega Dispute Letter Package if you haven’t already purchased it:

Dispute Letter Package

2. Sign up for Aura.com/rickita 14 day free trial to get your free reports (This will allow us to view your reports and lock Experian report)

3. Get all 3 of your credit reports from IDIQ $1 Trial:IDIQ Trial

4. Complete an application: Credit Application

5. Once you’ve made your purchase, reach out to our customer support team at 833-742-5482 to confirm your eligibility for the free letter service.